FINASTRA Factsheet 1

FUSION MIDAS

FUSION CORPORATE LENDING

The Advanced System for Corporate Banking -

Streamlined, Optimized Core Banking

Fusion Midas helps banks streamline and optimise their back-

office operations to become more efficient. Fusion Midas

puts your bank at the heart of your customers’ finances and

enables you to become the bank of choice.

Be more customer-relevant

Offer your corporate clients the best

services to meet their expanding needs.

By providing real-time views of cash

positions, you will empower your

customers to maximise working capital and

become more protable.

Rapid entry to new

geographical markets

Enter new markets with global processing.

By adding a new processing zone to the

global or regional hub, rather than having

to install a complete new system, you can

enter new markets quickly and easily.

Increased eciency and scalability

Process a range of transactions and

accounts in real- time, from data capture

and validation through to the generation

of settlement messages and accounting

entries. Fusion Midas incorporates industry

standards and high levels of automation

to increase eciency and handle growing

volumes as your business expands.

Unparalleled breadth of functionality

Benet from comprehensive instrument

and product coverage within a single core

banking system, including: current accounts,

cash management, loans, capital markets,

treasury instruments, trade nance products

and clean payments. Fusion Midas offers full

lifecycle processing for all transactions, and

enables you to enter new business areas or

increase participation in existing markets

from the same platform.

A componentised approach

Achieve total integration with a broad

portfolio of Fusion solutions, designed to

maximise the return on your investment.

Fusion Midas integrates with Fusion Digital

Channels and with Fusion Trade Innovation

and Fusion Risk solutions.

“

Fusion Midas opens up the

versatility of the system and the

possibility to grow in terms of

functional coverage..

”

A Global Private Bank

2 FINASTRA Factsheet

Today, treasurers expect a superior level

of service from their banking partners.

They require real-time views of cash,

exposures, assets and liabilities. And they

need this information on mobile devices.

Fusion Midas is a proven corporate

banking system that delivers this and

more. It builds on over 40 years of market

experience and development, so no other

corporate banking system comes close to

its functional richness.

Banks running on Fusion Midas can offer

the most sophisticated banking services

to their corporate clients. In tandem,

providing multinational corporates with

accurate global views of cash helps make

their customers more protable, and in

turn the banks can stay ahead of their own

competition. More than 100 banks around

the world rely on Fusion Midas. They have

the security of knowing that their business

will run smoothly and reliably, with no

systems outage.

Syndicated, bilateral commercial loans

With comprehensive analytics, it allows

you to report the exposure, income and

risks, associated with both agent and

lender functions. Fusion Midas supports

complex multi-level lending structures and

includes automated ‘past-due’ repayment

with balance checking pre-settlement, and

full collateral management.

Comprehensive corporate cash

management services

Benet from real-time processing

across all channels. Cash management

includes notional pooling, sweeping and

target balancing.

A single solution for trade nance

Streamline your entire trade nance

process to improve operational eciency

with a exible and multicurrency solution.

With automated processing of traditional

trade documents, such as letters of credit

and guarantees, you can process lines of

credit more quickly, improve transparency

to customers and offer superior service

level agreements.

The solution offers:

• Full integration with Fusion Trade

Innovation

• Common technology across trade

nance

• Unied data maintenance, position

management and accounting

Full straight-through processing

Automate the back-oce activities of the

treasury and capital markets operation,

from transaction capture and validation,

conrmation and settlement, through

to lifecycle management, accounting

and reporting.

Proprietary and interbank trading

Trade in a comprehensive range of nancial

instruments, including:

• FX and MM

• FRA and IRS

• Financial Futures

• Exchange-Traded and OTC Options

• Capital Markets

Fusion Midas is the most functionally rich core banking

system available, addressing the most complex business

needs of even the most complex conglomerates.

Stay Ahead of the Competition

FINASTRA Factsheet 3

Retail services

Automated processing of retail transactions.

Choose from a wide range of functionality,

including balance checking, real-time

updates, bank-dened interest and charges

and the production of statements, advices

and other items of correspondence.

Fusion Midas also includes an integrated

teller function to initiate transactions, resolve

customer enquiries and manage teller and

vault totals.

Centralise and consolidate

You can benet from scale by

consolidating IT operations globally, or

on a regional hub. Branches or groups of

branches can run on a single Fusion Midas

environment, signicantly reducing costs.

Automated settlement conrmation

and payments

Gain a step-change improvement in

processing for most types of transactions,

through external networks or internally

managed accounts. Fusion Midas

supports a broad range of clean payments,

including incoming payments from

correspondent banks, typically received

through SWIFT, or from domestic banks

through local clearing systems. Straight-

through processing is further enhanced

using SWIFT directory services to

validate and convert data. Fusion Midas

is fully Continuous Linked Settlement

(CLS) compliant.

Standard and user-dened reports

Choose from an extensive range of standard

operational reports with the option to produce

user-dened reports to meet specic bank

or local regulatory requirements. The Fusion

Midas Optical Reporting Facility is a powerful

archiving and report mining tool, which

enables all reports to be archived intelligently,

while bank-dened ‘List Views’ provide bank

structured enquiries where data can be

grouped, sorted and ltered, with drill-down to

detail, with print and export capabilities.

Changing legislation and

market practice

Keep up to date with changes in legislation

and market practice. As well as providing

standard bank audit reports, Fusion Midas

is regularly upgraded to help you comply

with emerging legislation. You can also

monitor suspicious activity and set up

watch lists.

With a single database, you will achieve

an enterprise-wide view of management

information, while retaining the exibility

to comply with local market practice

and regulations. Global processing

makes it easier to enter new markets by

implementing a regional hub – rather than

having to install a complete new system.

Control credit risk and exposure

Choose from a range of tools to measure,

report and control customer risk, and

improve internal control using tiered

authorisation limits and real-time credit

exposure reporting at capture and all

authorisation steps.

Technology has become a key driver of commercial

success. Fusion Midas offers unparalleled functional

richness for all aspects of corporate banking.

LENDING PAYMENTS TREASURY

TRADE SERVICES CAPITAL MARKETS

ACCOUNT/CASH

MANAGEMENT

• Bilateral

• Syndications

• Facilites

• Collateral

• Past due

• Financial Guarantees

• Outgoing

• Incoming/STP

• Standing orders

• Direct debits

• Cheques

• Credit transfers

• Foreign exchange

• Money markets

• FRA/Swaps

• Import/export LCs

• Trade guarantees

• Bills

• Equities

• Bonds

• Derivatives

• OTC/structured

products

• Corporate actions

• Custody

• Interest sales

• Statements

• Balance management

• Overdraft control

• Sweeps

• National pooling

OPERATIONS - BACK OFFICE

SETTLEMENTS AND MESSAGING CREDIT RISK CONTROL CUSTOMER CORRESPENDENCE

• Messaging routing

• SWIFT

• Domestic clearing

• Nostro management

• CLS and FX netting

• Credit lines

• Offsets

• Confirmations

• Advices

• Statements

INTERNAL SERVICES

INTEGRATION COMPLIANCE AND RISK FINANCIAL MANAGEMENT SECURITY & AUDIT

• Pre-defined APIs

• Interface toolkit

• Integration framework

• Middleware

• KYC/AML

• Basel III

• IAS 39

• Audit exception reporting

• Transaction posting

• Financial accounting

• Management accounting

• Manual postings

• Non-financial accounting

• Reconcialiation

• Business intelligence

• Regulatory reporting

• User access control

• Audit/exception reporting

• 2/4/6 eyes authentication

• Database integrity

Fusion Midas consolidates hundreds of functions into a single back oce,

using a single database.

About Finastra

Finastra unlocks the potential of people and businesses in fi nance, creating a platform for open innovation. Formed in 2017

by the combination of Misys and D+H, we provide the broadest portfolio of fi nancial services software in the world today –spanning

retail banking, transaction banking, lending, and treasury and capital markets. Our solutions enable customers to

deploy mission critical technology on premises or in the cloud. Our scale and geographical reach means that we can serve

customers effectively, regardless of their size or geographic location – from global fi nancial institutions, to community banks

and credit unions. Through our open, secure and reliable solutions, customers are empowered to accelerate growth, optimize cost,

mitigate risk and continually evolve to meet the changing needs of their customers. 48 of the world’s top 50 banks use Finastra

technology. Please visit fi nastra.com

Finastra and the Finastra ‘ribbon’ mark are trademarks of the Finastra group companies.

© 2018 Finastra. All rights reserved.

North American Headquarters

120 Bremner Boulevard

30th Floor

Toronto, Ontario M5J 0A8

Canada

T: +1 888 850 6656

GL 1034 / 0618

Full multi-entity processing

You can meet the most sophisticated

accounting requirements with multiple

divisions or branches. Fusion Midas

provides accounting reporting at

department, customer and product level.

Flexible customisation and integration

External developer framework and user

dened elds allow banks to develop their

own customisation of screens and new

elds. A wide range of rich Application

Program Interfaces (APIs) enable

integration of key satellite systems the

bank may be running.

An independent global bank, Banco Finantia

has more than 20 years’ experience in key

market niches, including investment banking,

private banking and specialised nance.

Private banking and specialised nance

activities are centred in the Iberian Peninsula,

while investment banking serves the Iberian

Peninsula, Latin America and the Turkish,

Russian and CIS markets.

Banco Finantia wanted to extend its market

reach and modernise its customer service

offerings. A large software environment, with

relatively little integration between business

areas prevented the bank from developing

these new opportunities cost-effectively.

The bank chose to consolidate on Fusion

Midas for back-oce eciency and to create a

platform for growth.

Fusion Midas enables Banco Finantia to

expand its customer offerings rapidly and cost-

effectively, exactly as the market demands.

Fusion Midas Enables Banco Finantia to Extend

and Modernise Cost-Effectively

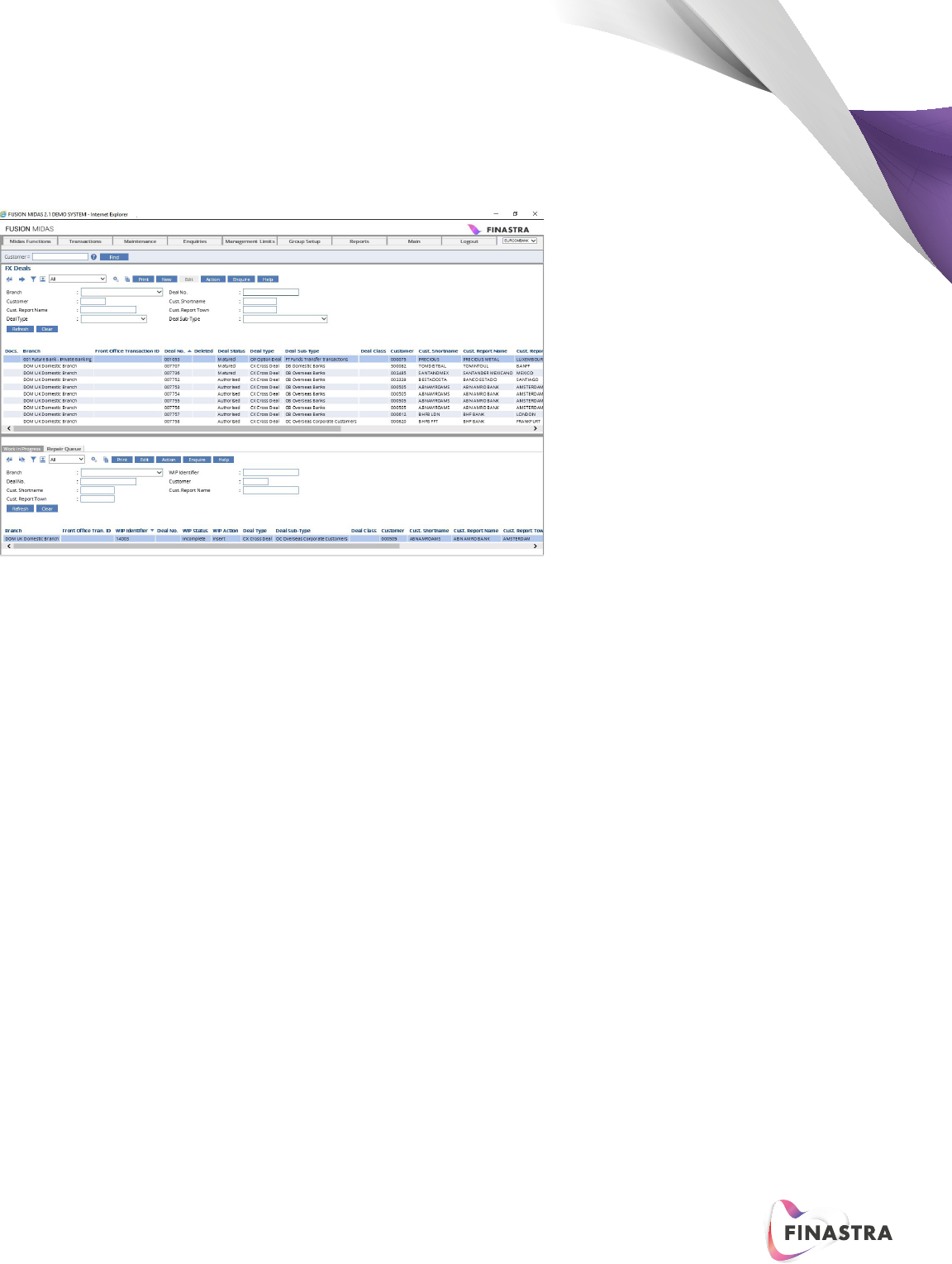

Sample Fusion Midas enquiry screen